Made by Certified Accountants

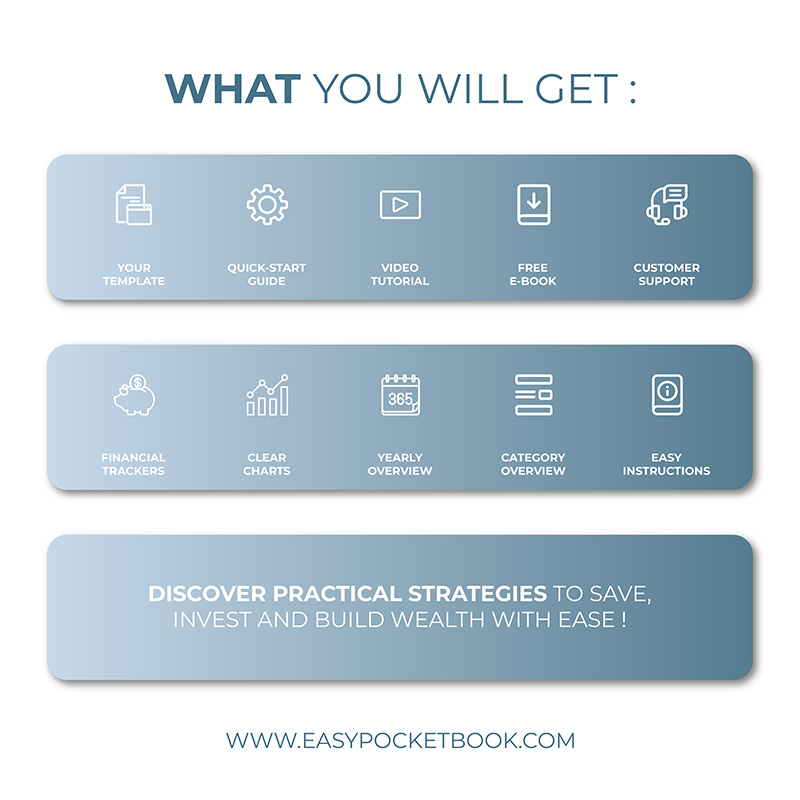

Free Ebook with Every Purchase

Achieve Financial Freedom Today

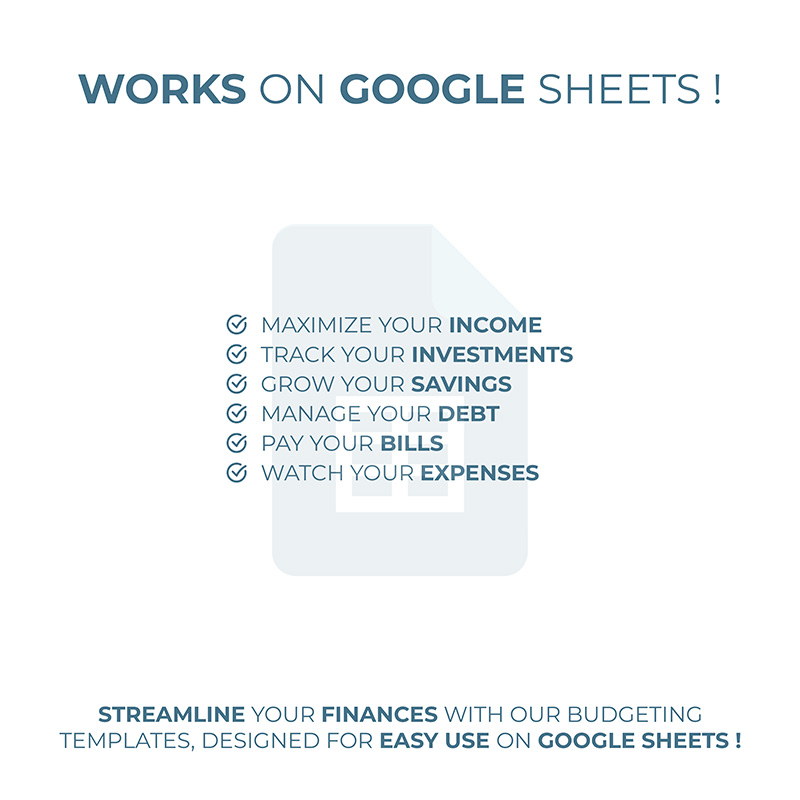

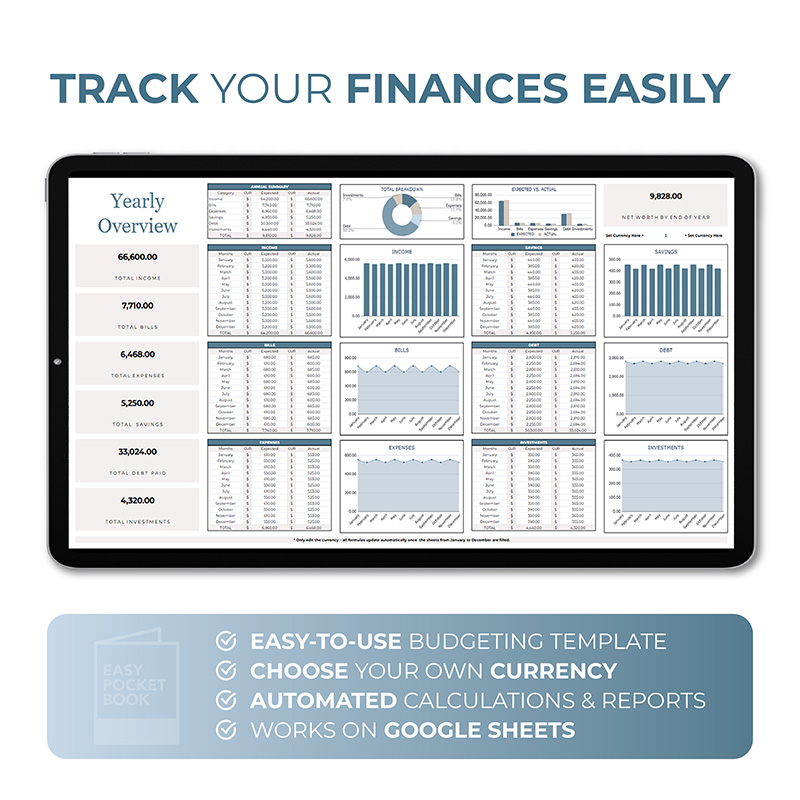

All-in-One Budgeting Templates

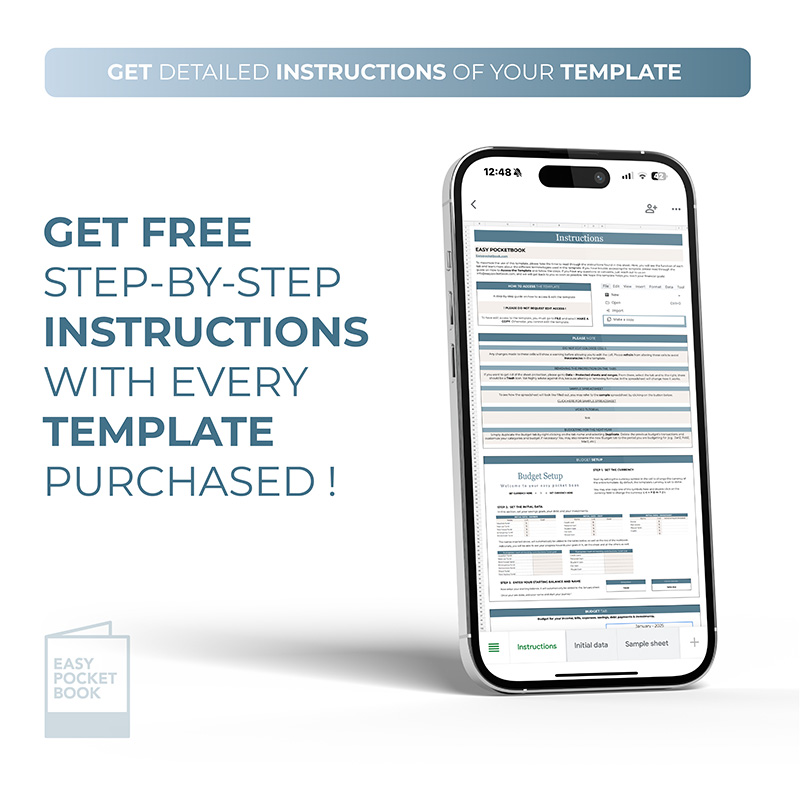

Smart Budgeting Made Simple

Made by Certified Accountants

Free Ebook with Every Purchase

Achieve Financial Freedom Today

All-in-One Budgeting Templates

Smart Budgeting Made Simple